US marine industry: election caution impacts consumer confidence – but hope on the horizon

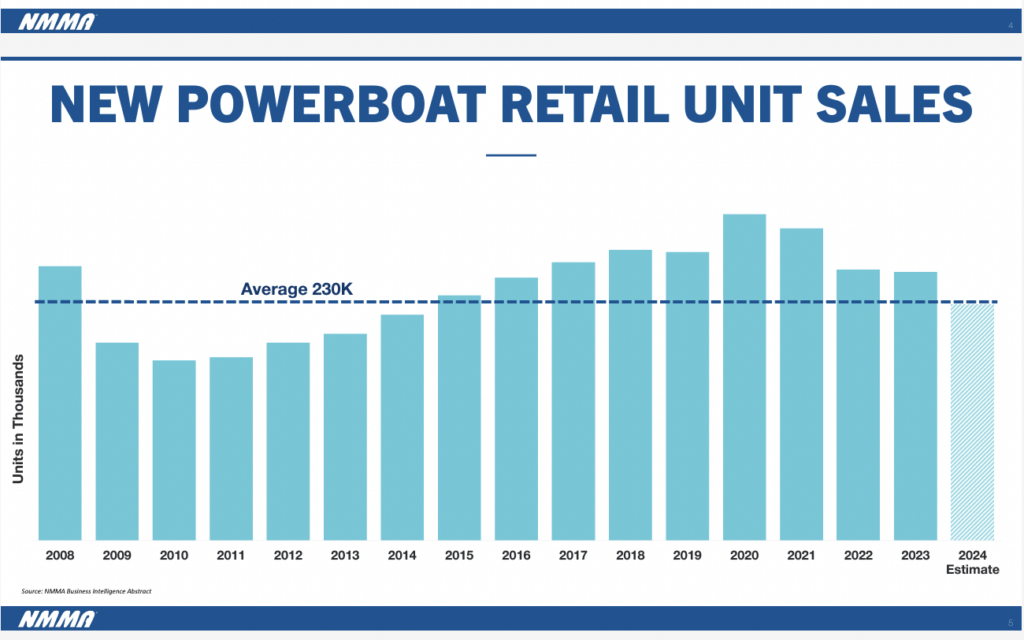

The industry had one of its best runs through the recent global pandemic. New boat sales reached the highest levels in decades, and first-time boat buyers soared to record heights. But the post-covid slump – combined with global headwinds – has seen the US leisure marine market face very challenging times in 2024.

During his State of the Industry breakfast meeting address to 900 delegates at IBEX, National Marine Manufacturer’s Association president and CEO, Frank Hugelmeyer pointed to tough times but a strong hand to be played. “I don’t think I need to tell anyone here that the industry is battling some headwinds,” Hugelmeyer said. “Interest rates are easing but are still high. Powerboat sales are down about 12 per cent. While consumers are feeling slightly more optimistic, consumer sentiment is still shaky.”

Yet across the IBEX show floor and during the address, Hugelmeyer pointed to positives. He flagged September 2024’s Federal Open Market Committee meeting, when the Federal Reserve (Fed) lowered interest rates by 50 basis points, easing monetary policy for the first time in four years due to progress on the Fed’s dual mandate, as key. While a higher cut than most anticipated in the finance market, it is unlikely to salvage the fourth quarter of the year for dealers and OEMs. The rate lowering is welcome news on several fronts as it lowers the carrying costs on dealer inventories, lowers government spending due to interest payments on debt, and should lead to stronger economic growth. Further expected rate cuts are expected and will continue to aid relief.

Exhibitors were cautious but optimistic — the general consensus being that the industry downturn hit bottom earlier this year and the leisure marine market is picking itself up with positive gains expected in 2025.

“While there are significant changes happening, there are also great opportunities, and the recreational boating industry is poised to take advantage of them,” says Hugelmeyer.

The big election question

The pending November 2024 US election provides yet more drag and reluctancy in the market. The uncertainty of the election outcome is causing more consumer conservatism when it comes to spending. With a tight US election too close to call spending, at best, stagnates.

The Trump tax cuts expire in 2025 and it is yet to be seen if they will be extended or allowed to expire. Massive spending deficits in the US may require higher taxes. Higher taxes will reduce consumer discretionary income. Plus, candidates from both political parties have been talking about increasing tariffs.

Tariffs will likely be inflationary and also reduce consumer discretionary income as the products they buy cost more. How the election outcome will impact military conflicts in Eastern Europe and the Middle East, which will impact government spending and the global economy, is also yet to be seen, adding further question marks.

Dealers and OEMs hope for signs of recovery and more consumer confidence after November when the election is in the rear view mirror.

The good news is that inflation is lowering and weakening GDP. And the expectation is that the current recession in the US recreational boating industry will continue through 2024. The industry should keep a close watch on their potential impacts, but into mid 2025, there is hope of increasing positive shifts.

Retail boat sales will recover first, perhaps in the first part of 2025, and that will lead to increasing new boat production in the second or third quarter of 2025 as dealer inventories return to more normal levels.

The post US marine industry: election caution impacts consumer confidence – but hope on the horizon appeared first on Marine Industry News.