MarineMax reports record financial results

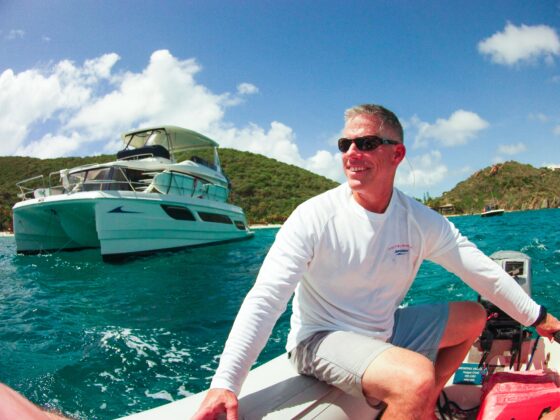

Recreational boat and yacht retailer, MarineMax has announced record results for its second quarter, increasing its revenue by 17 per cent.

This growth, an increase from US$523.1 million to to US$610.1 million, was due to recent acquisitions and a ‘strong demand for boating’. Same-store sales grew 7 per cent plus a 45 per cent increase in the comparable quarter last year.

W. Brett McGill, chief executive officer and president of MarineMax, says, “We once again delivered record sales, earnings growth and cash flow in the quarter, driven by strong same-store sales growth up against a very tough comparison of 45 per cent a year ago. Our market share is expanding as we introduce new customers to MarineMax and the boating lifestyle.

“Our exceptional customer service, affirmed by our record Net Promotor customer satisfaction levels, has resulted in many of our existing customers upgrading to larger and newer boats.

“I am extremely proud of our team’s execution as we extend our long record of producing meaningful same-store sales growth, even on top of significant compares, while executing on our balanced growth strategy.”

MarineMax, which recently invested in online retailer Boatzon, reported similar record-breaking figures earlier this year.

The company’s significant geographic and product diversification, in combination with accretive acquisitions, and growth in gross profit, drove more than a 37 per cent increase in net income to US$53.5 million and a 40 per cent increase in earnings per diluted share to US$2.37. This compares to earnings per diluted share of US$1.69 in the comparable period last year.

For the six months ended 31 March 2022, revenue grew 16 per cent to US$1.083 billion compared with US$934.6 million for the same period last year.

McGill concludes, “As we enter our most active season, our demand and backlog provides us with continued confidence for the balance of fiscal 2022 and beyond. We anticipated two years ago that boating would be one of the beneficiaries of a changed world. This quarter is evidence of the sustainability of that trend and MarineMax’s ability to leverage our scale, global presence, product diversification, technology advancements, strong balance sheet and cycle tested team.

“Our record March quarter margins reflects the success of our ongoing focus of growing our higher margin and recurring revenue. The combination of robust operating leverage, significant cash flow and strong consumer demand will support sustainable internal and acquisition growth as we continue to enhance long-term shareholder value.”